VAT adjustments are now a lot easier to update in Xero, you can now use the tab ‘adjust’ in the VAT return.

For instance if you had an adjustment from a previous year or require to disclose your Postponed Accounting disclosure, you can now use the ‘adjust’ tab to reclaim it correctly through the next VAT return. You would run the current VAT return as you would usually (please see below) and enter in the VAT amount you wish to adjust.

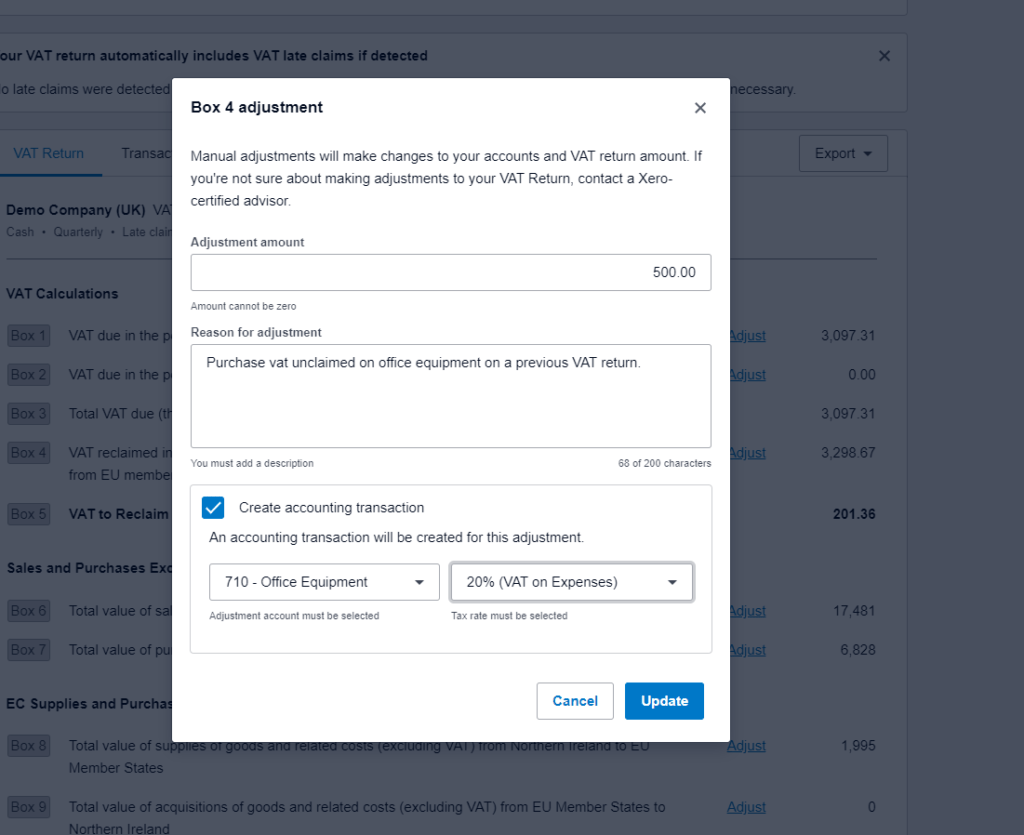

I have used the example of below with a reclaim value of £500.

As this is a reclaim on purchases, you should enter this amount into Box 4, the result of the £500 being added to this box, will be an increase in the reclaim amount. By selecting office equipment for the code, this will reduce the cost of the office equipment in the Balance Sheet by £500 to the correct net value.

Please note though, if the net value of your late VAT correction entries are over £10,000 you will need to complete a late VAT Error Form and submit this to HMRC separately.

If you wish to discuss this or any other matters concerning Xero further, please get in touch with the Plus Advisory Team.

Author: Debbie Marriott, Xero & VAT Advisor @ Plus Accounting

Contact me on 01273 701200 or email debram@plusaccounting.co.uk

Date published: 31 August 2022